Tracking Care Minutes: Sector Performance July–September 2025

February 13, 2026 | Care Minutes

The latest Care Minutes in Residential Aged Care Dashboard (Department of Health, January 2026) provides a clear snapshot of how Australian residential aged care homes are performing against mandated care minute requirements. At Mirus, we know these numbers aren’t just metrics — they are indicators of workforce strategy, resident care quality, and funding risk.

How the sector is performing

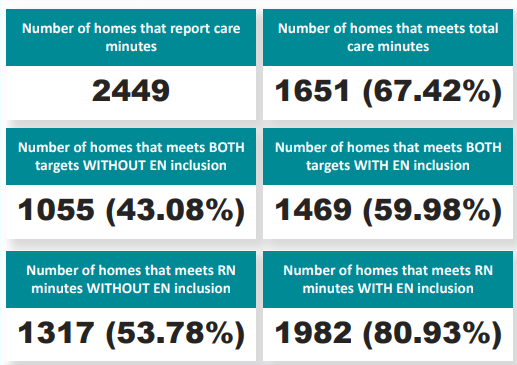

Across 2,449 homes reporting care minutes:

- Total care minutes target: 1,651 homes (≈67%) are meeting their total care minute targets.

- RN minutes target: Only 1,317 homes (≈54%) meet the RN minutes requirement without counting Enrolled Nurse (EN) contributions.

- Both targets: 1,055 homes (≈43%) meet both total and RN minutes on their own staffing highlighting where RN availability is a persistent challenge.

Performance by Provider Type

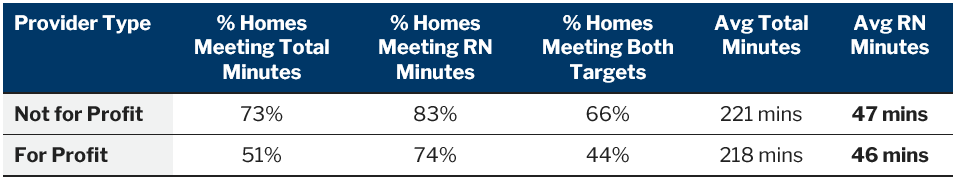

Breaking performance down by ownership type reveals interesting patterns:

Not-for-profits consistently outperform for-profits across all measures. This may reflect differences in workforce investment, rostering practices, and operational priorities.

The additional tax burden on for-profit providers means they must be even more diligent with their P&Ls to achieve the same financial performance as NFPs.

We benchmark all our data across these two cohorts and historically the two organisation types behaved quite differently and aligned to significantly different data markers in several KPIs such as Average Daily Subsidy (ADS), occupancy, claiming activity and of course, care minute performance. The past 18 months have seen behaviour change with the cohorts now aligning very closely in ADS, occupancy and claiming.

The variance in care minute performance is largely caused by the difference in employment costs between the two organisation types. It is frequently the case that the cost of meeting a care target is more expensive than the cost of the penalty for not meeting it. The higher the cost of employment, the more frequently this scenario occurs, while lowering employment costs through fringe benefits such as salary packaging makes it easier to add minutes at a price that is lower than the penalty.

The sector is increasingly trending towards compliance. While it may currently be economical for some homes not to meet targets, this position will become harder to sustain as they become outliers.

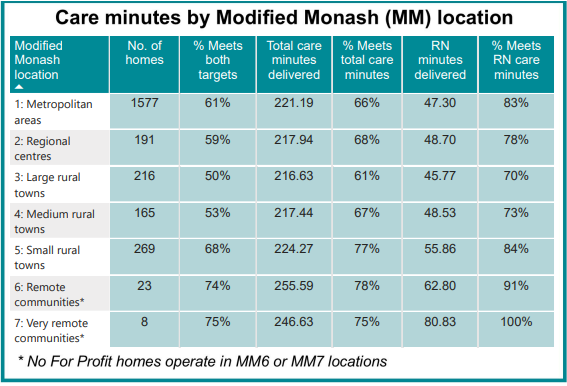

Geographic Insights

Care minute compliance also varies by location (Modified Monash Areas):

- Remote & very remote communities: 74–75% of homes meet both targets — often higher than metropolitan homes.

- Small rural towns: ≈68% of homes meet both targets.

- Metropolitan and larger regional towns: 50–61% meet both targets.

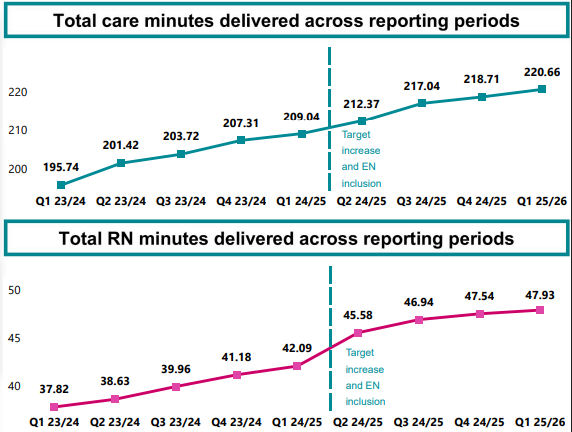

Trends Over Time

Quarterly reporting shows steady progress:

- Total minutes delivered have been trending upward.

- RN minutes are increasing gradually but remain below target in many metropolitan and for-profit services.

This is a positive signal for the sector overall, but homes that continue to lag in RN minutes may face compliance and funding challenges.

Implications for Funding

From April 2026, the Commonwealth will link a portion of residential aged care funding to care minute delivery through the care minutes supplement:

- Providers meeting both total care and RN minute targets will receive full supplement funding.

- Those failing to meet targets risk reduced or no supplement, impacting revenue.

- A sliding scale applies: the closer your home is to compliance, the more funding is retained.

Small adjustments to rostering, recruitment, and workforce allocation can protect funding while improving resident care. Homes that plan proactively will be better positioned to navigate these changes.

Register now for your personalised Care Minutes Funding Report

At Mirus, we’ve developed a dedicated Care Minutes Funding Report to help providers with a view of:

- Flags for potential roster overspend where care minute targets are exceeded

- Your care minute performance by facility for the most recent quarter and the prior three quarters

- An analysis of funding at risk under the new model