October AN-ACC pricing update explained

September 29, 2025 | AN-ACC

The aged care pricing update taking effect on 1 October 2025 delivers a headline 4.67% increase in the Australian National Aged Care Classification (AN-ACC) base price. The base subsidy will rise to $295.64 per resident per day. While this looks like a positive increase on paper, our analysis highlights that this uplift masks underlying financial pressures for providers.

What’s changing

Several key elements of the October update will affect funding:

- Price increase: The new AN-ACC price of $295.64 represents a 4.67% uplift. When combined with rostered care minute supplements, the average daily subsidy for a typical provider rises to $307.55, only a 3.4% increase.

- NWAU recalibration: The National Weighted Activity Unit (NWAU) mix determines how funding is distributed across resident classes. Since AN-ACC was introduced, the average NWAU per resident has fallen from 0.573 in October 2022 to 0.553 in October 2024, and is projected to decline further to 0.536 in October 2025 — a 6.5% reduction in funding capacity.

- Base Care Tariff adjustment: For Modified Monash (MM1) services, the base care tariff is reduced by $33.41 per bed day. Providers will only recoup this amount if they fully meet their mandated care minute targets.

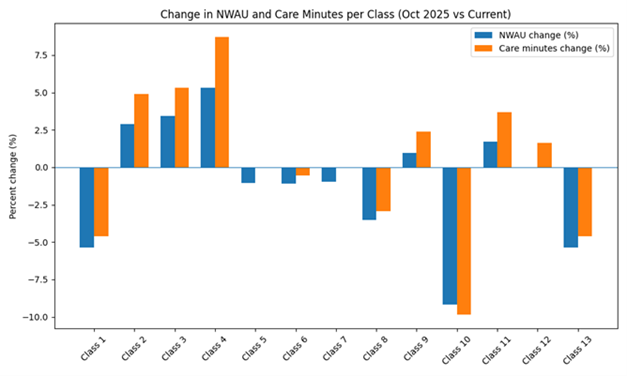

Changes by class

Funding shifts will not be evenly distributed across resident classes:

- Weights up: Classes 2, 3, 4, and 9 see modest increases, with respite strengthening significantly.

- Weights down: Classes 1, 7, 8, 10, and 13 decrease, with larger reductions for 10 and 13.

- Minimal change: Classes 5, 6, and 12 remain relatively steady.

The reductions to high-dependency classes raise important concerns. These residents often need intensive nursing and behavioural support, yet current funding levels may not be keeping pace with the complexity of their care needs.

Understanding the impact

The effect of these changes will vary by service. For some providers, shifts in funding levels and case mix may lead to roster overspend; for others, they may create new compliance considerations or reduce access to supplement funding. Increases in funding and care minutes can be just as challenging to manage as decreases.

Success depends on how effectively providers adapt their claim profiles to align with their target model of care, roster utilisation, and care minute compliance. Targeting specific classes is not an effective strategy, as individual resident care needs and AMO assessments cannot be influenced directly. A more practical approach is to consider the entire resident cohort.

For example: “The roster is aligned to the quarterly target, but the current resident case mix has declined, so ideally the claim profile can uplift by the delta of minutes.”

Hidden cost pressures

While subsidies rise on paper, providers face higher operating costs. Care minute targets continue to increase, and labour expenses are climbing. Analysis shows that after paying award wages and staffing to meet the new care minute obligations, the average provider may be left with just 97 cents per resident per day. This narrow margin leaves limited capacity to absorb wage pressures, compliance costs, or unplanned roster changes.

What the changes mean for providers

For many services, the 2025 update will feel more like a cost shift than a windfall:

- Net funding per resident may decline for providers whose resident mix does not change materially.

- High-dependency residents may become financially unviable unless providers intensify assessment and classification efforts.

- MM1 homes must track care minutes carefully to reclaim the base care tariff reduction.

- Future price growth is constrained by the declining NWAU, so providers cannot rely on annual uplifts to restore margins.

Practical steps for providers

A proactive approach can help providers navigate these changes:

- Model funding under the new weights to understand how current class mix translates to subsidy changes.

- Pressure test rosters to align staffing levels with care minute targets at the lowest sustainable cost.

- Prioritise reassessments to ensure residents are accurately classified to reflect care needs and funding entitlements.

- Refocus admissions to maintain financial sustainability through an appropriate class mix.

- Educate boards by providing directors with a clear picture of price effects, mix impacts, and cost pressures before strategic decisions are made.

Looking ahead

The October 2025 aged care pricing update signals a turning point. Base prices may climb, but declining NWAU values and new compliance obligations mean many providers could see net funding fall. Boards and executives should reassess financial assumptions, examine class mix strategies, and seek expert guidance to ensure long-term viability.

Providers can request a personalised FY26 Budget Reforecast Report to see how the October AN-ACC pricing update and care minute changes will affect their organisation and sites. Reports use real service data to forecast expected funding and care minute requirements.