Aged Care Providers lift prices by 8.7% Year to Date

July 22, 2025 | Aged Care Management

By Tyler Fisher, Data Scientist

Across the aged care sector, there has been a notable shift in accommodation pricing strategy following the 1 January increase to the maximum permissible Refundable Accommodation Deposit (RAD), which rose from $550,000 to $750,000.

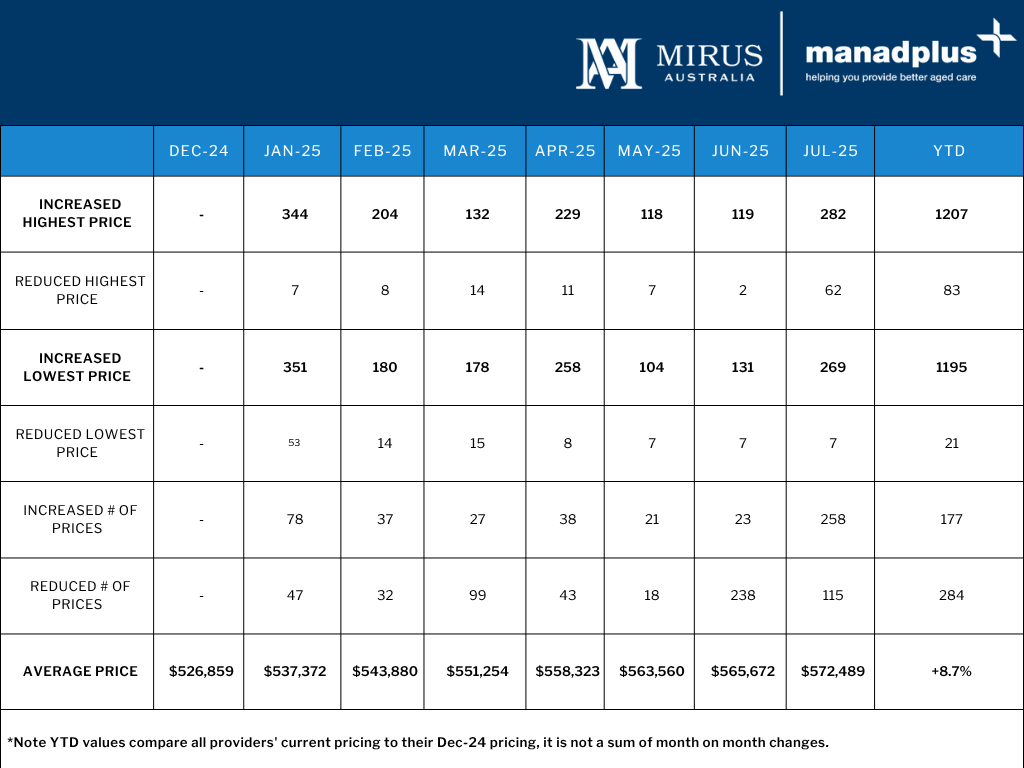

So far this calendar year, we’ve seen RADs increase by an average of 8.7%, based on pricing activity tracked across residential aged care facilities nationwide. This marks a strong shift in strategy, with more than 1,200 providers increasing their highest advertised RAD and nearly 1,200 lifting their lowest price points.

After several years of pricing stability, providers are now recalibrating their accommodation pricing in response to the expanded RAD ceiling. This is a significant moment in the market. However, pricing is only part of the story—value perception is critical. The providers that are most successful are those aligning pricing strategies with genuine value through refurbished facilities, premium offerings, and clear differentiation.

Despite the volume of price increases, there’s also strong evidence of tactical repositioning. So far in 2025:

- Over 80 providers have reduced their highest RADs

- More than 280 providers have consolidated their pricing by reducing the number of unique RAD price points

While some of these pricing adjustments are a response to broader market shifts, others reflect a more nuanced, localised approach to remain competitive or reposition underperforming rooms. There’s a strategic tension at play—pricing up where there’s demand and quality, while still needing to remain accessible in markets where affordability is under pressure.

The delay in passing the new Aged Care Act, originally expected to take effect from 1 July, has added another layer of uncertainty. Some providers may now adopt a “wait-and-see“ approach to further changes. However, the direction of travel is clear.

Further clarity around regulatory and funding settings will only intensify the need for aged care operators to evolve their go-to-market strategies. RAD pricing is one of the few levers providers have in a tightly regulated environment—but with that comes responsibility. Residents and their families will expect to see value in return.

As aged care continues to evolve, staying competitive means combining data-led pricing decisions with real, meaningful value propositions that meet the expectations of today’s consumers.

Need help with accommodation pricing?

Our Accommodation Pricing Report helps you stay informed about your local market by providing detailed insights into competitor pricing, room types, and price ranges. This tailored report takes the hassle out of tracking frequent changes so you can set the right prices confidently.

You can subscribe to receive four quarterly reports per facility for $999 (saving $997), or purchase individual reports at the regular rate of $499 each.