Admissions Management: 2020 Review

February 8, 2021 | Mirus Admissions

Natanya Full, Head of Admissions at Mirus Australia, summarises Admissions Management in Aged Care for the year 2020. The data is collated from our valued Mirus Admissions clients and de-identified.

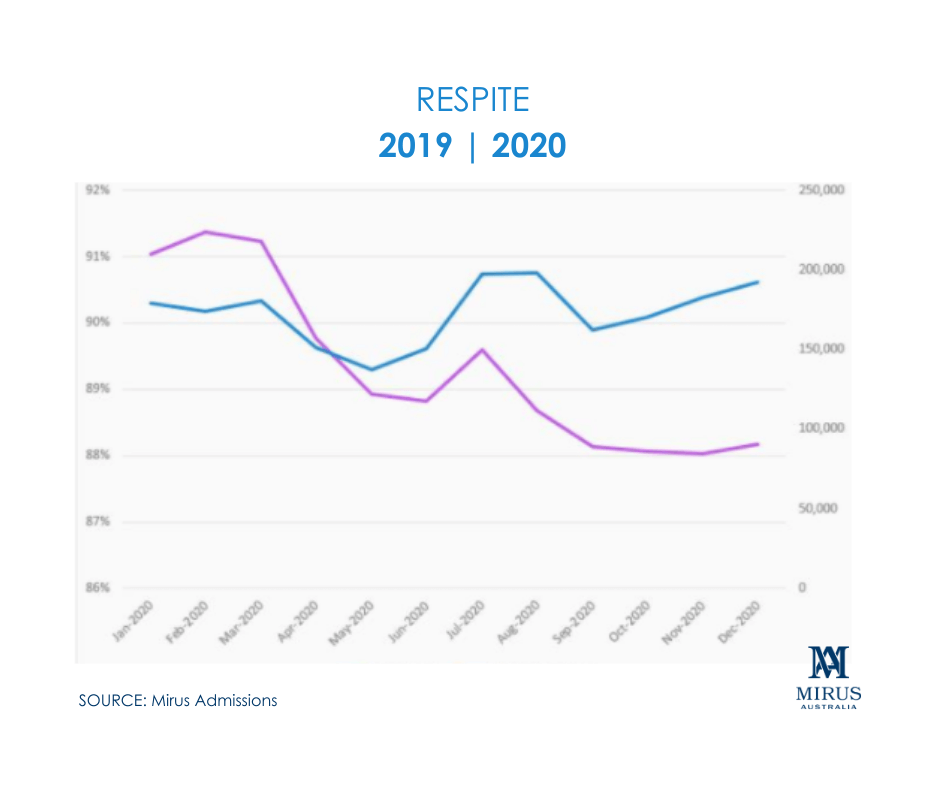

Occupancy in Aged Care:

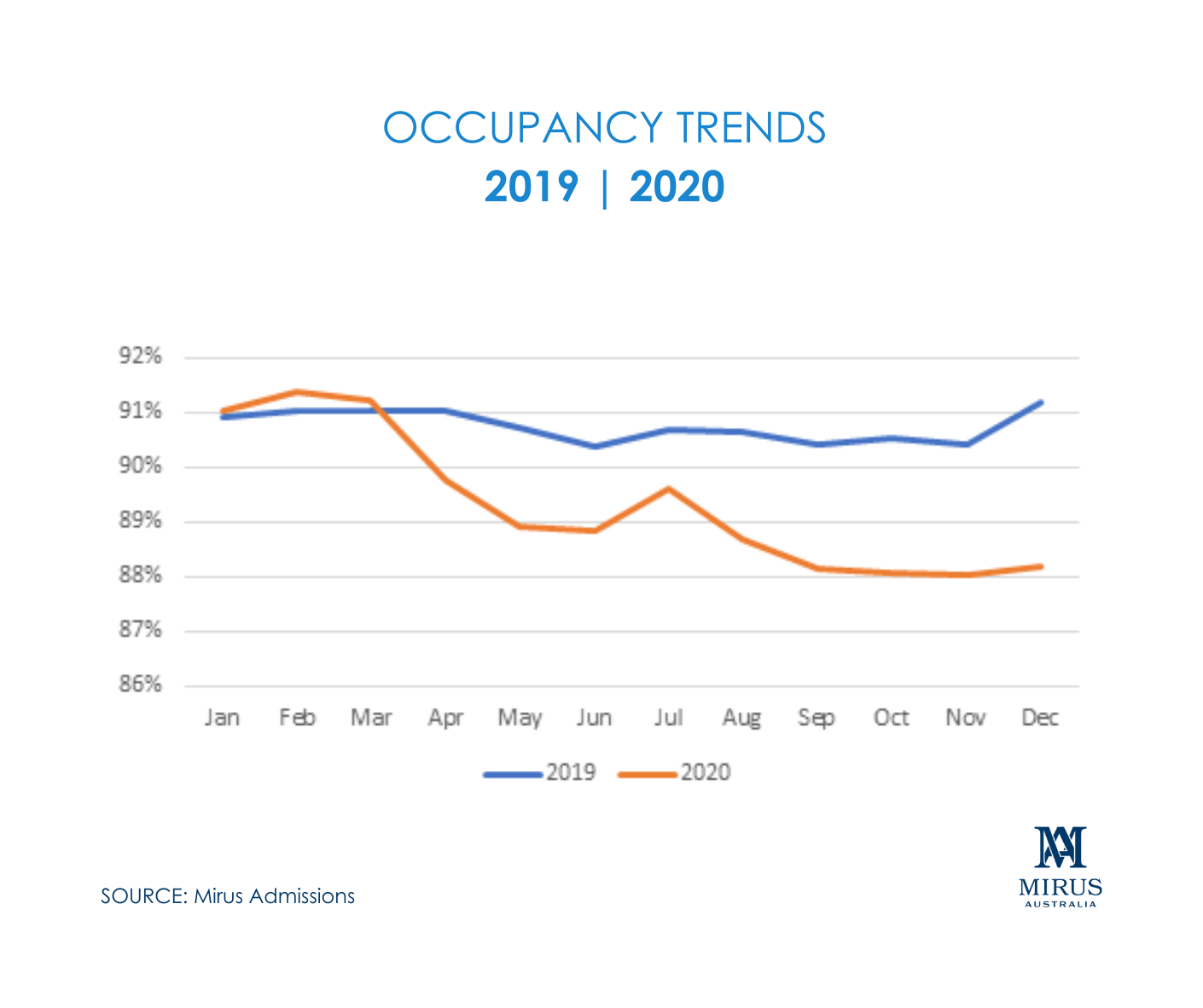

Undoubtedly, it was a tough year for occupancy in residential aged care in 2020. The year started with relatively stable occupancy by maintaining 2019s highest occupancy rate of 91% until March 2020.

However, it started to take a dive in April 2020 and after a slight peak in July, has continued to decline to the lowest point in 24 months of 88% and hasn’t really budged from there since September 2020.

“Let us all be the Leaders we wished we had”

Simon Sinek

Admissions

- New admissions followed a similar trend to occupancy. For the industry, there were 4,500 less people entering as permanent residents in 2020 compared to 2019.

There were a several factors influencing this:

- Significant release of Homecare packages in March and June 2020 resulted in many people who would otherwise move to a low care facility now remaining at home

- The delay, and deferral of new admissions due to COVID- 19 (reduced visitation, quarantines, no tours to visit sites, fear)

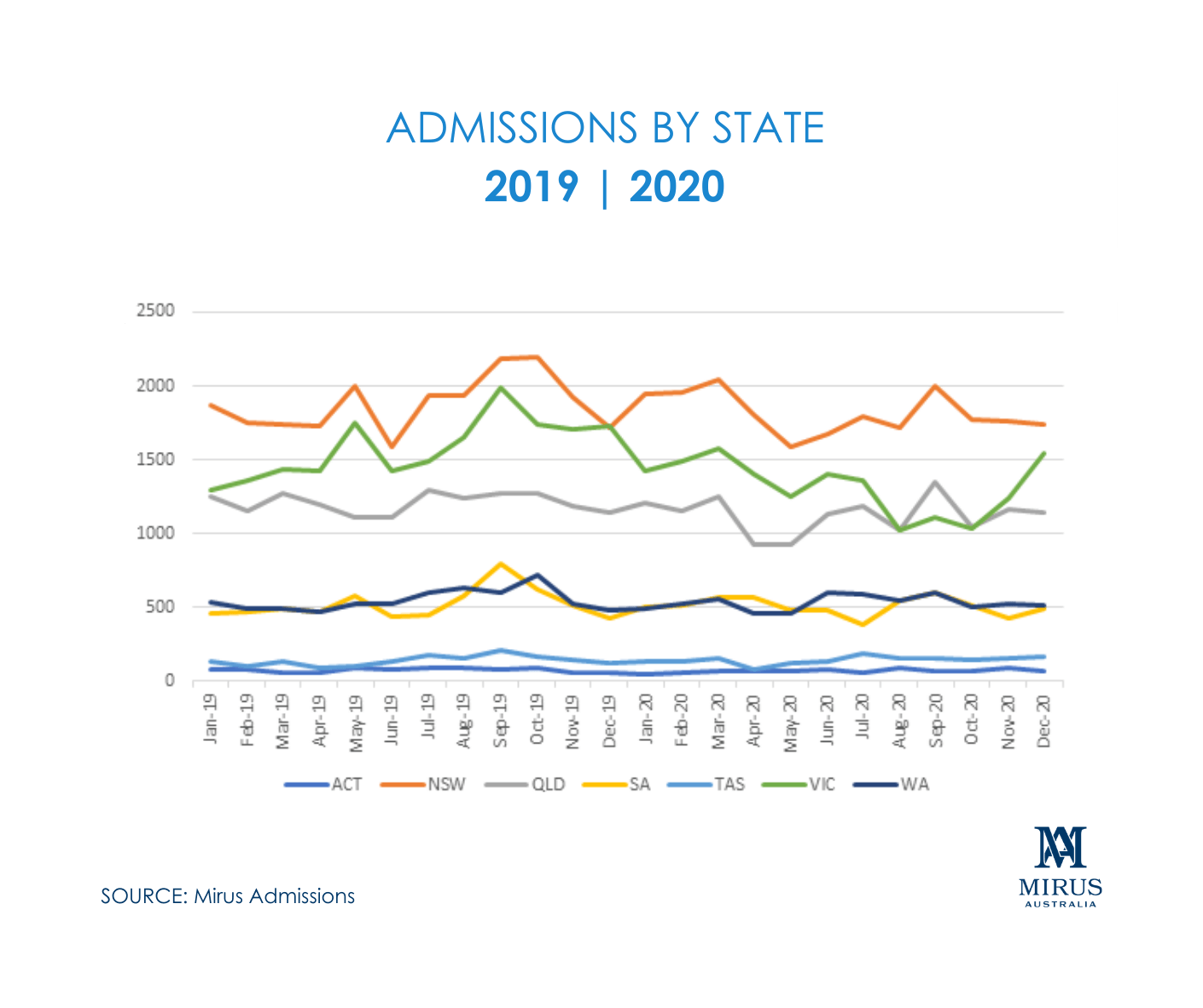

- Some states maintained stable in terms of volume of admissions month on month – see ACT, WA and SA

- Victoria experienced the greatest decline in new admissions in line with having the strictest and longest lockdown period due to the pandemic

- In 2019 there were approximately 6000 new residents entering care each month, compared to 5,500 per month in 2020.

- The highest months for admissions in 2020 were March 2020 followed by September 2020 where the industry saw more than 6,000 residents entering care across the country

The decline in occupancy can largely be attributed to COVID 19 pandemic, associated lock downs and a significant release of Homecare packages in March and June. These things combined resulted in many people staying in their homes longer rather than entering aged care.

Respite

- Respite days used and occupancy are strongly correlated. The fact that occupancy has even remained at 88% is impressive given what the sector has faced! Many providers have been offering incentives for carers and families to take up respite and this has had a positive impact on occupancy

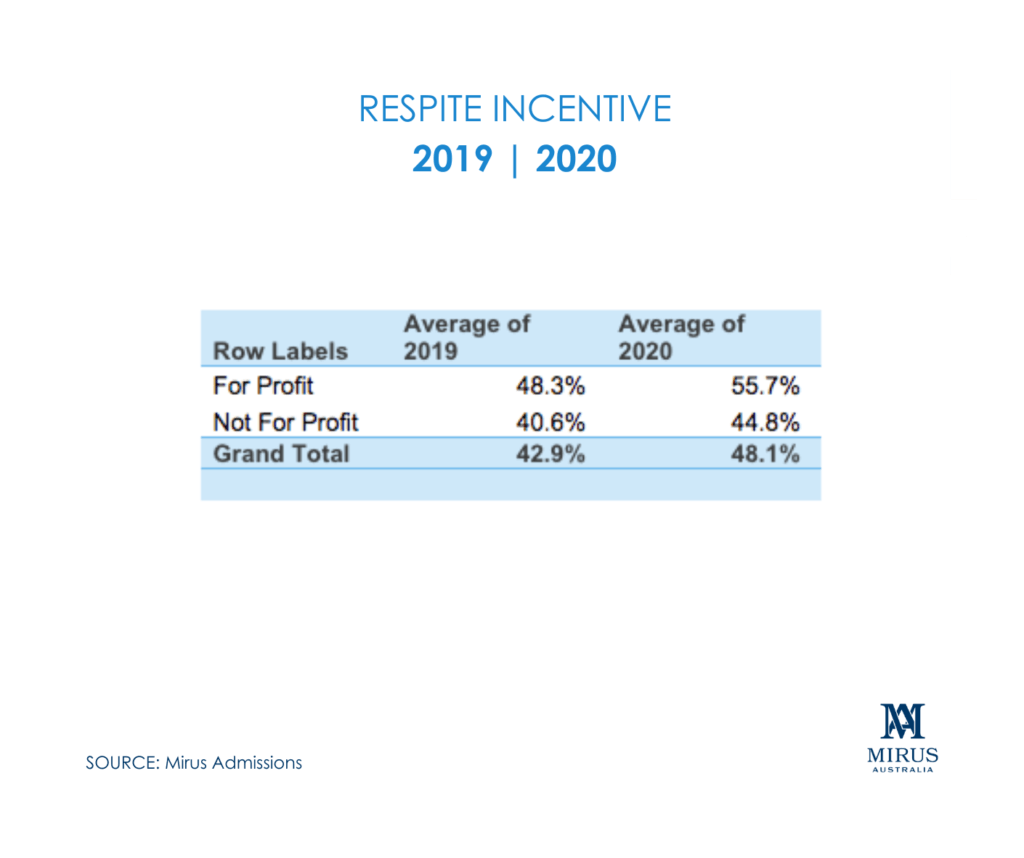

Respite incentive

- The number of facilities receiving the respite incentive has increased in 2020 compared to 2019 for both cohorts. Currently 48% of the industry are receiving the respite incentive suggesting that providers are becoming more proactive about managing respite days.

ADS – Average Daily Subsidy

- The ADS of new admissions grew in 2020

- Perhaps indicative of the fact that people with lower care needs were choosing to remain at home and bed places were going to those with the most urgent needs

Current Mirus Admissions clients:

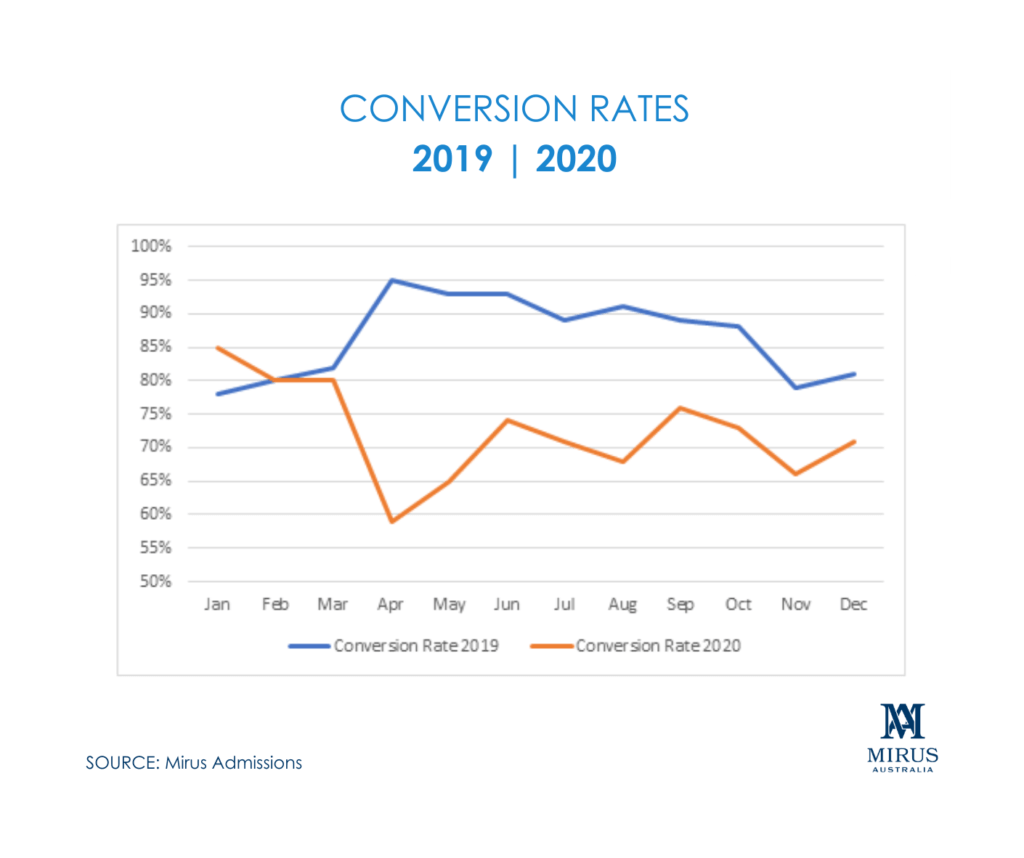

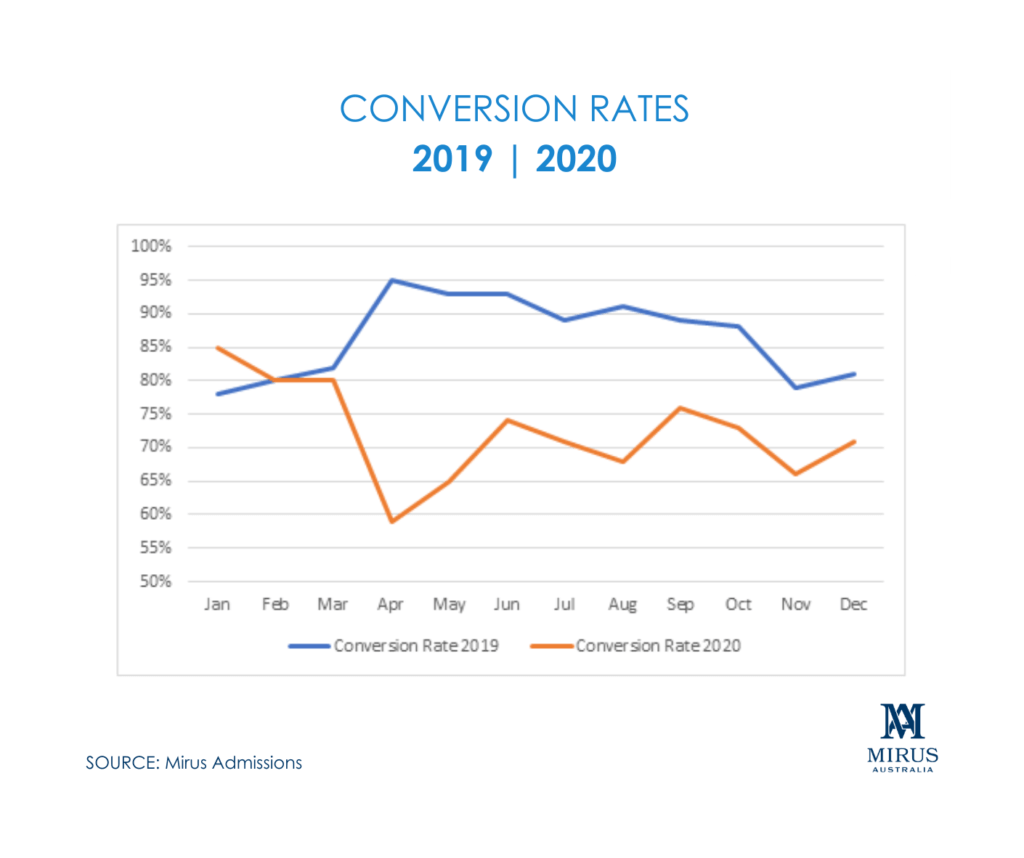

Conversion rates were down in 2020 compared to 2019, that is number of admissions (wins) compared to number of lost sales

The month with the lowest conversion period was April with 59% of lost admissions during the nation-wide lockdown. However rates have picked up and there has been an upward trend since April through to December. The 2020 average conversion rate was 71% compared to 81% in 2019.

We have observed that the clients who are closing more sales have engaged their team in sales training and have systems and processes to improve communication, and efficiency and therefore results. High performing clients have also invested in strong networks with local hospitals and community groups as referral networks.

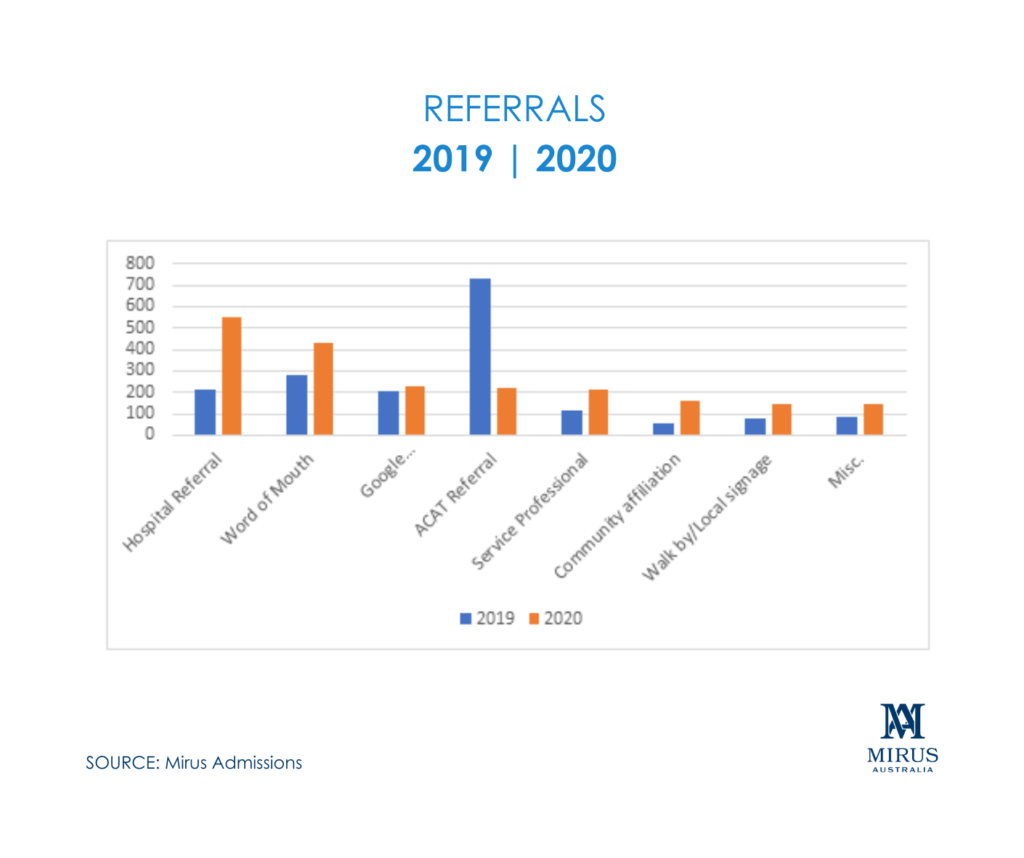

- 2020 saw more referrals coming through hospitals, compared to 2019 where most came through ACAT referral.

- Interestingly, the second most common referral channel over the past two (2) years in word of mouth emphasising the importance on customer experience, and building strong networks within community groups.

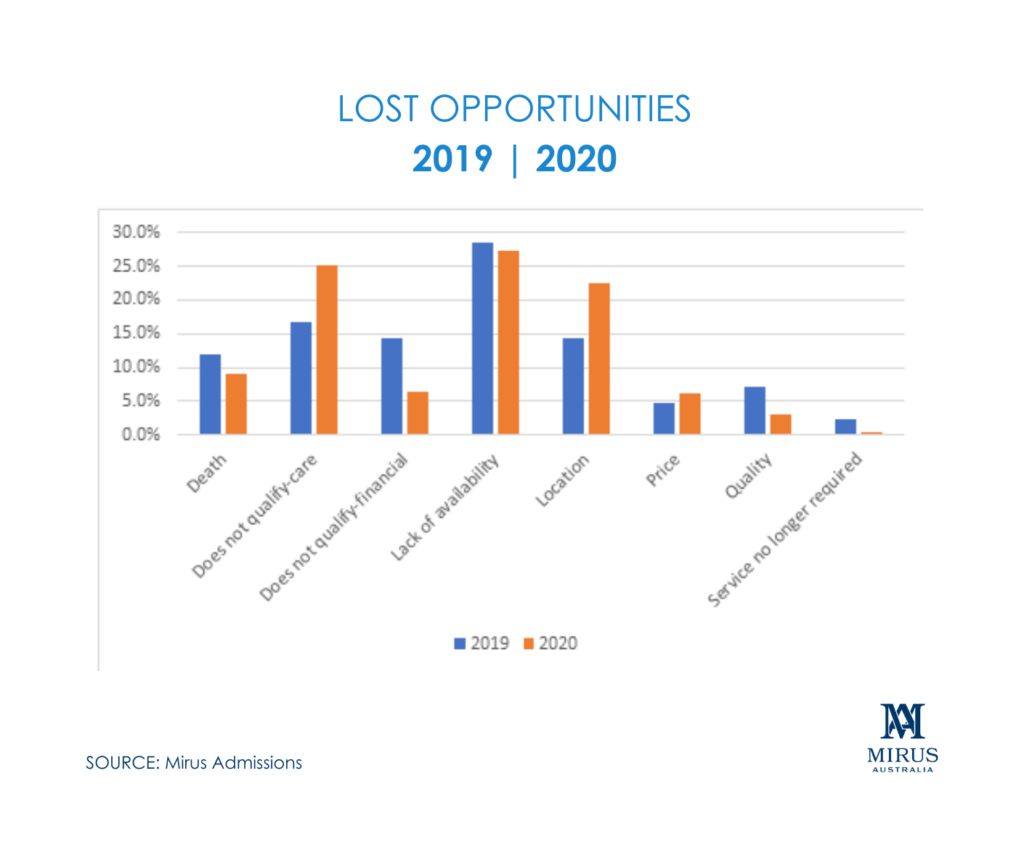

The most common reason for losing a sale, or closing an opportunity was: lack of suitable availability. This largely relates to the mis-match of client needs and accommodation on offer. And has resulted in many providers considering ways to become more flexible in their offerings to capture the market as customer needs change over time.