Accommodation review at a glance

August 9, 2023 | Aged Care Finance

By Tyler Fisher, Data Scientist

Millions left on the table

AN-ACC and care minutes get a lot of attention as they are the largest portion of income and expense respectively, and for the first time they are legislatively linked. This means higher subsidy levels will always lead to higher care minute requirements and therefore expenditure. Therefore the margin that will be available is fixed and it is relatively small when compared to the ACFI returns realised previously by many providers.

Ultimately this means providers who feel funding is inadequate must look beyond care subsidies for additional revenue. Accommodation payment arrangements are under scrutiny in Canberra, but we have no sense of what changes might be in store, how significant they are or how quickly they may help providers realise additional funding. Within the current framework however, there is still plenty of capacity to improve for most providers.

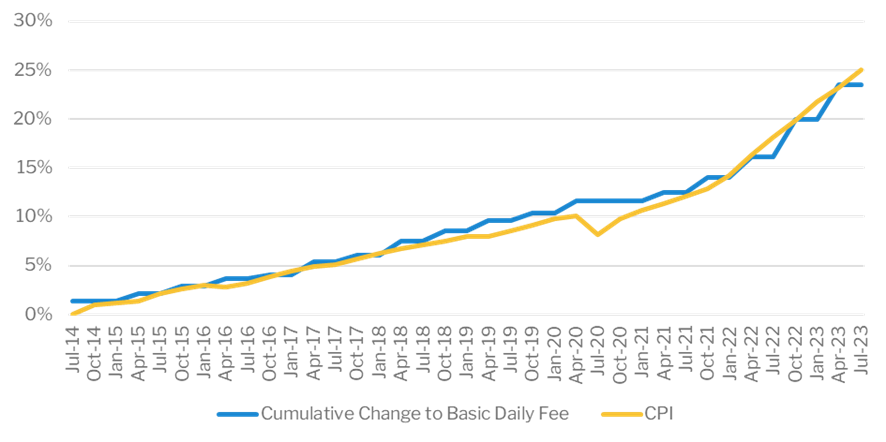

The fee everyone pays for aged care is not likely to change, even with a significant overhaul to accommodation payment arrangements. It is also not going to do the heavy lifting that is required to improve provider balance sheets. The basic daily fee is calculated according to the aged pension and the aged pension is indexed according to cost of living. So, as we can see, the daily rate of the basic daily fees changes in line with CPI.

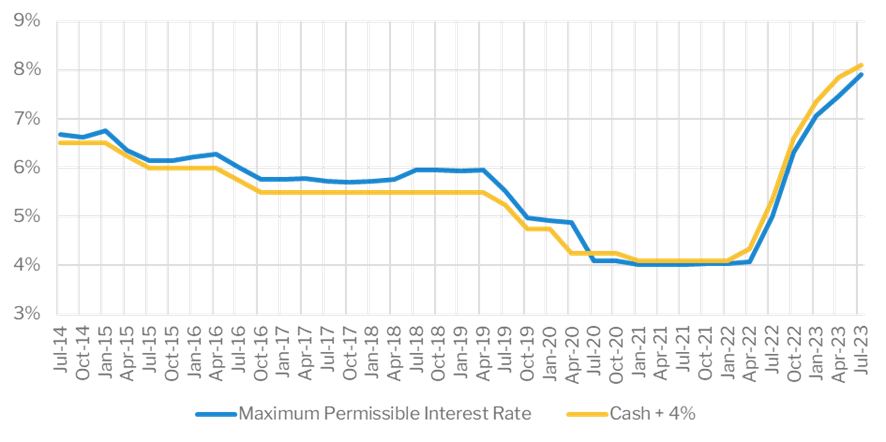

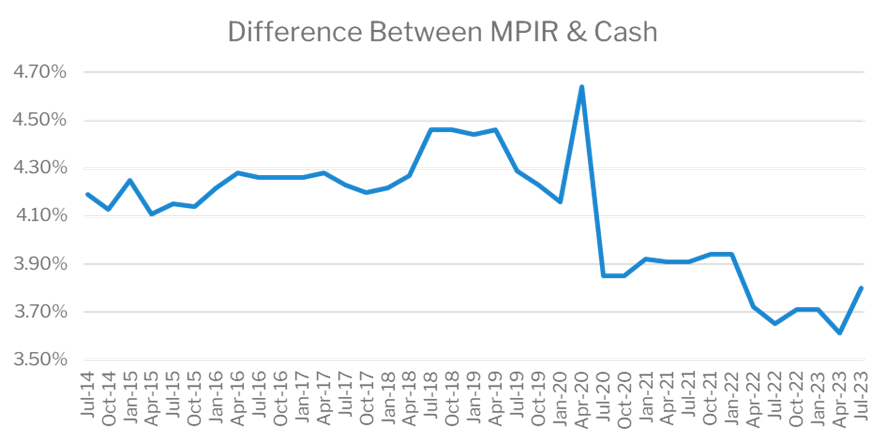

When we get into the mechanism that should yield more for provider income statements, it is important to understand the role of the Maximum Permissible Interest Rate (MPIR). The MPIR approximates the cost of capital for an aged care provider, the rate they would have to pay to borrow money. When Living Longer Living Better (LLLB) was introduced in 2014, interest rates were near historic lows. Interest rates reduced even further because of the pandemic and are now rapidly increasing due to inflationary pressure. This means the system for calculating Daily Accommodation Payments (DAPs) has significant potential volatility. The MPIR is basically calculated as the cash rate plus four percent. However, pre-pandemic, the MPIR was consistently above the cash plus four percent measure but has been consistently below this comparison since mid-2020. At a macro level this distinction is significant and has led to erosion in accommodation revenue over a period that saw housing boom along with cost of living.

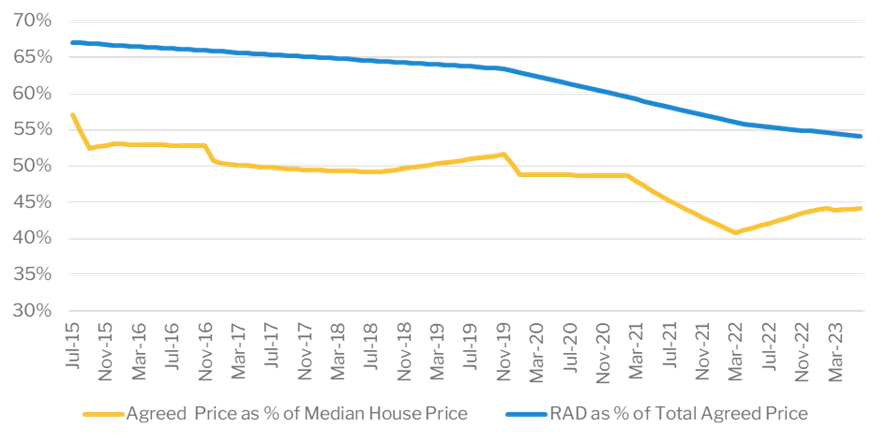

CPI has been relatively steady with a brief slowdown in 2020 and slightly larger increases recently. In contrast, from 2015 the median house price has increased over 50%. Over the same period the agreed room price has increased 18%, 7% off the pace of CPI and 32% behind housing. For consumers looking to sell their primary residence to fund a RAD, the daily equivalent becomes much more attractive. Combined with the extremely low interest rates we already discussed, DAPs are very cheap and produce lower yields. Over the years this caused the industry RAD/DAP ratio to decline 13% to the current balance around 54%.

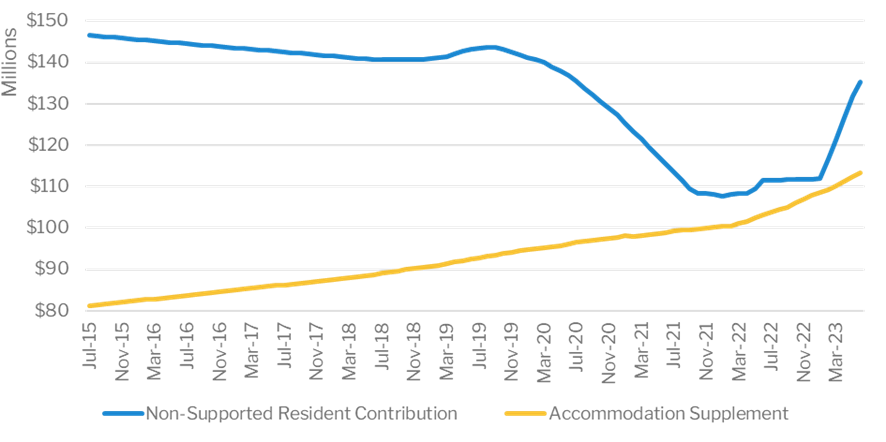

Like the other Commonwealth contributions, the accommodation supplement is indexed so far less volatile. Looking at non-supported revenue from accommodation payments, meaning the combination of an implied return from refundable deposits and daily payments, we can see the impact of extremely low interest rates. The implied return is slightly lower because permitted uses of RADs are quite restrictive and the DAP is significantly lower.

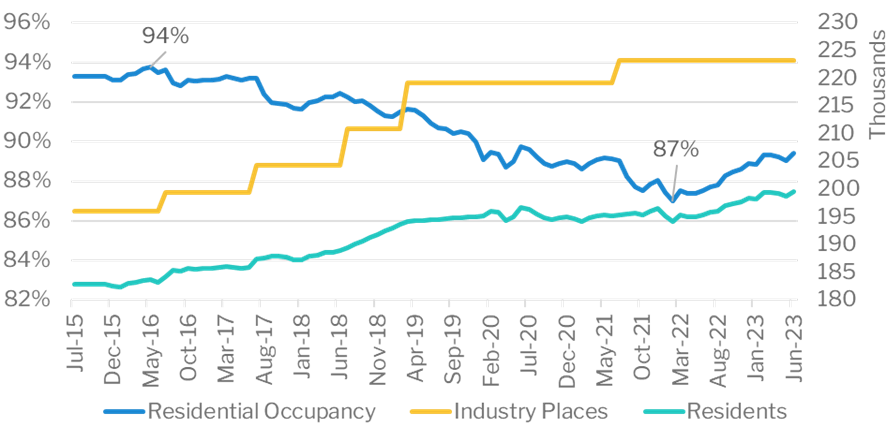

Occupancy declined steadily from 2016 to 2022 as a result of new bed licences being issued regularly during that period. The total number of residents in care increased consistently however, apart from a slow down during the pandemic. Despite there being more residents and an increase in agreed prices, the non-supported accommodation revenue for the industry has decreased by 8% in eight years. Providers who have hit the upper limit of room prices at $550,000 can seek to get approval for higher prices and many have, but most of the industry has not reached that boundary with on average $100,000 left on the table for each non-supported admission.