Mirus Industry Analysis October 2019

November 25, 2019 | Aged Care Finance

Mirus Industry Analysis or MIA is our monthly video + blog series that brings to you all figures and statistics related to the industry. Andrew Farmer, Chief Executive Officer of Mirus Australia joins Rob Covino in this episode to discuss Business Strategy & interim Business Tactics for Aged Care Providers within this environment of rapid change.. Click here to download Mirus Australia’s answer to each of the 8 new Aged Care Quality Standards.

For all support queries please contact our team here. Please send us any questions you might have regarding the information on MIA here.

[To watch the full video, click here.]

ADS & Occupancy

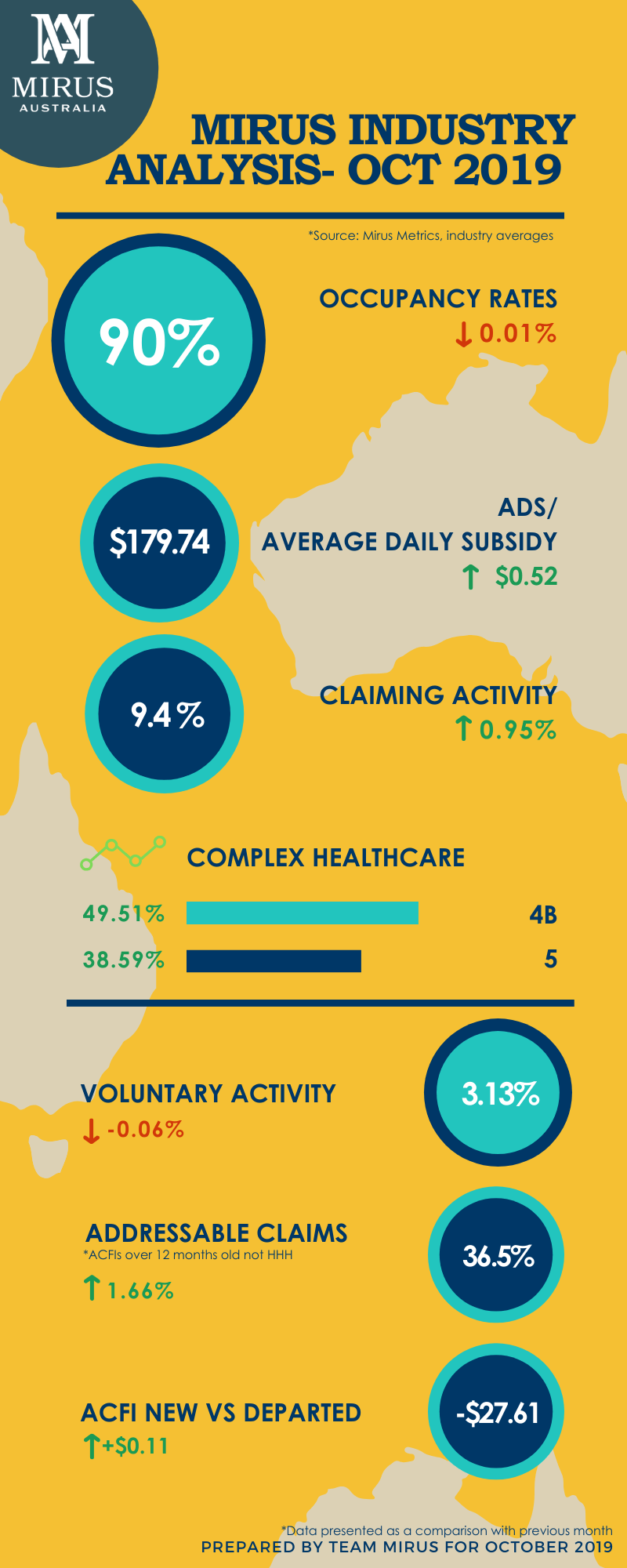

The Average Daily Subsidy was up across all three cohorts with the industry at $179.74; with the private operators are at an all time high at $188.37 and not-for-profits at $176.03. Whereas Occupancy had a relatively flat change across the 3 segments, with the not-for-profits down at 90.94%, the private operators up at 88.87% and the industry average is at 90.28%.

Consumer acquisition strategies and having the right information at the right time through an efficient CRM tool is key to maintaining your Occupancy.

(To check if your CRM is working for you and to improve your Admissions Process & Occupancy please visit our CRM Self-diagnosis tool.)

Claiming Activity

Overall Medicare claiming activities in October 2019 was green across all 3 cohorts. The industry average went up to 9.39% (a growth of 0.95%) with the private operators at a claiming activity of 11.19% (+1.68%). They are leading when compared to the not-for-profits who are currently at 8.72% (A decrease of 0.62%).

(If you are looking for consistency between clinical documentation and supportive evidence for ACFI claiming, please visit Mirus CASE from our ACFI team, to quickly product high quality assessments, care plans and funding claims.)

MIA October 2019 infographic

Voluntary Claims

The voluntary claiming activity or proactive claiming was down across all 3 cohorts, the industry average being 3.13%. The private operators are at 3.30% (decrease by 0.32%) and the not-for-profits are at 3.06% (decreased by 0.02%). This is a good measure of productivity and an indicator that can drive the ADS upwards.

Addressable Claims

The overall percentage of addressable ACFI Claims (older than 12 months not HHH indicating they are eligible for voluntary claiming), was up across all 3 segments, with the industry average at 36.45% (+1.66%). The not-for-profits went up to 39.17% and the private operators went up to 29.79%. The private operators as can be seen have a faster and more aggressive process around this.

Variance: New Vs Departed ACFI

When we look at the average ACFI of new residents compared to departed, we calculate the variance of the ADS between these two segments. The industry average variance now at $27.61, with the private operators are leading at $24.84 and the not-for-profits are at $28.71.

For a benchmark level, the Mirus ACFI experts suggest a variance of $20 per day to be maintained as a good performance indicator for your facility. If you’d like to read more on ACFI optimisation, click here.

Complex Health Care Domain

Within the complex health care domain, we’ve seen a steady increase in the 4B procedures, with the industry average at 49.51% which also correlates to some of the strategies used by the industry to push the ADS up. The private operators are at 52.11% of all claims having a 4B claim attached to it within the medicare data, whereas the not-for-profits are at 48.39%. The continence 5 claims also increased, with the industry average at 38.59%. The private operators are at 44.20% and the not-for-profits are at 36.17% here.

Workforce Trends

The workforce trends in both care and non-care hours during October 2019 was positive. Non-care hours were up by 8.41% (0.86 hours) and the care related hours grew by 5.73% (2.40 hours). If we unpack the care related hours, the agency hours went up by 12.52% (0.06 hours), the AIN hours was up by 7.35% (1.69 hours) and the Allied Health hours grew by 6.2% (0.13 hours). The RN hours increased by 1.45% or 0.57 hours and EN hours slumped by 9.4% or 0.01 hours per bed per day basis.

Andrew Farmer, CEO of Mirus Australia joins Rob in this month’s MIA, to discuss Revenue Management. Connect with Andrew on LinkedIn here.

With the significant amount of changes happening in the industry, we urge providers to have a look at their CRM & see if it’s working for them. Please use our CRM Self Diagnosis Tool for the same.

If you would like to get in touch with us please do so here.

Drop in a topic request for our blogs here.

See you next month!

-Team Mirus